Global financial services firm leverages Crux’s buyer advisory services to execute time-sensitive tax credit transaction

A global financial services and technology company approached Crux in the summer of 2025 with an unexpected tax-planning challenge. After identifying an unexpected need to offset its tax liability, the company hoped to quickly secure clean energy tax credits ahead of its upcoming tax filing deadline.

The company needed to source approximately $25 million in 2024 tax credits at a point in the year when the remaining market inventory of 2024-vintage tax credits was limited. Crux’s market research has found that the vast majority of 2024-vintage credits transact in 4Q2024 or 1Q2025. As a first-time tax credit buyer, the company also needed a partner that could not only source a supply of high-quality tax credits, but also facilitate transaction execution and provide expert guidance throughout the process.

Established network for efficient credit sourcing and transaction support

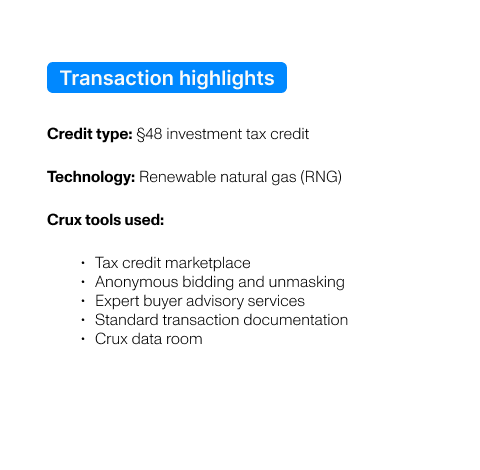

In just two weeks, Crux' sourced suitable credits through its established market relationships. Crux’s team of transaction experts connected the company with a developer and operator that had a portfolio of renewable natural gas (RNG) projects that met the buyer’s required amount of 2024 investment tax credits (ITCs). Crux identified this opportunity early after the developer’s deal with a previous buyer fell through, providing the financial services firm with first access to the newly available credits.

Crux also introduced the firm to experienced law firms in its partner network to act as buyer’s transaction counsel. The company quickly engaged an experienced law firm to support its first transaction — a critical aspect of a successful transaction close, particularly on a short timeline.

Expert market intelligence builds transaction confidence

Crux supported the buyer throughout the transaction process, including:

- Walking through the initial stages of engaging with a seller.

- Advising on appropriate pricing and terms, backed by Crux’s market-leading dataset of more than $40 billion in closed transactions.

- Reviewing diligence and financial information to support the buyer.

- Facilitating final closing and wiring.

Following the transaction close, the buyer maintains access to the data room on Crux’s platform for easy, organized access to diligence materials for compliance purposes.

Custom-built tools streamline the diligence process

Crux's platform and suite of transaction tools allowed the seller to efficiently organize and share diligence materials with the buyer and buyer counsel. The platform’s data room leverages large language models to scan available documents and organizes them into a streamlined diligence review checklist, making it easier for buyer counsel to find the required documentation. That organization and efficiency was key in this transaction, where the credits came from a portfolio of multiple projects that all required separate documentation on an expedited transaction timeline.

A successful and efficient transaction close

By partnering with Crux, the first-time buyer was able to secure the credits it needed in just weeks. Despite limited inventory in the broader market, the buyer closed the transaction ahead of its tax-filing deadline. Crux’s established seller and professional network, tech-enabled platform, and expert advisory services provided support through each step of the deal, leading to a more efficient and confident deal closing.

Contact us to learn more about how Crux can support your tax investment strategy.