In January 2025, the Internal Revenue Service (IRS) published Notice 2025-08, the First Elective Safe Harbor, updating its May 2024 notice regarding the elective safe harbor for the domestic content (DC) bonus adder. The DC bonus adder is available for certain projects qualifying for the production tax credit (PTC) and investment tax credit (ITC) (§45 and §48) tax credits, including for the tech-neutral §45Y and §48E, which became available at the beginning of 2025. Projects that demonstrate that they meet the IRS requirements for domestic content sourcing are entitled to a 10% bonus on the value of the project’s tax credit.

The 2024 notice introduced a new safe harbor, offering simpler calculations for project developers seeking to qualify for the DC bonus. Previously, the IRS required developers to calculate the manufactured costs for their US suppliers, including the materials costs for goods supplied, the wages paid to workers, and payroll taxes. Some manufacturers were reluctant to supply this information, which made it challenging for projects to qualify for the DC bonus. In the 2024 notice, the IRS acknowledged the complexity, saying they “are aware that obtaining a manufacturer’s direct costs of manufacturing may require the taxpayer to gather cost data from multiple suppliers and manufacturers, including foreign manufacturers, and may present challenges for substantiation and verification.”

The elective safe harbor simplifies the process for certain technology types, including solar photovoltaics (PV), land-based wind, and battery energy storage systems (BESS). In a press release accompanying the notice, the IRS said it plans to issue guidance for other technologies, including offshore wind.

Crux has observed that some projects that developers and manufacturers believe qualify for the DC bonus nonetheless face difficulties monetizing the credits stemming from the bonus. Consequently, the share of projects that indicate they qualify for the DC bonus is relatively low. This share is expected to increase substantially over time as more US manufacturing comes online. Reducing the compliance burden by simplifying the process of qualifying for the bonus will likely help more projects transfer these credits and increase the demand for US-made products and components.

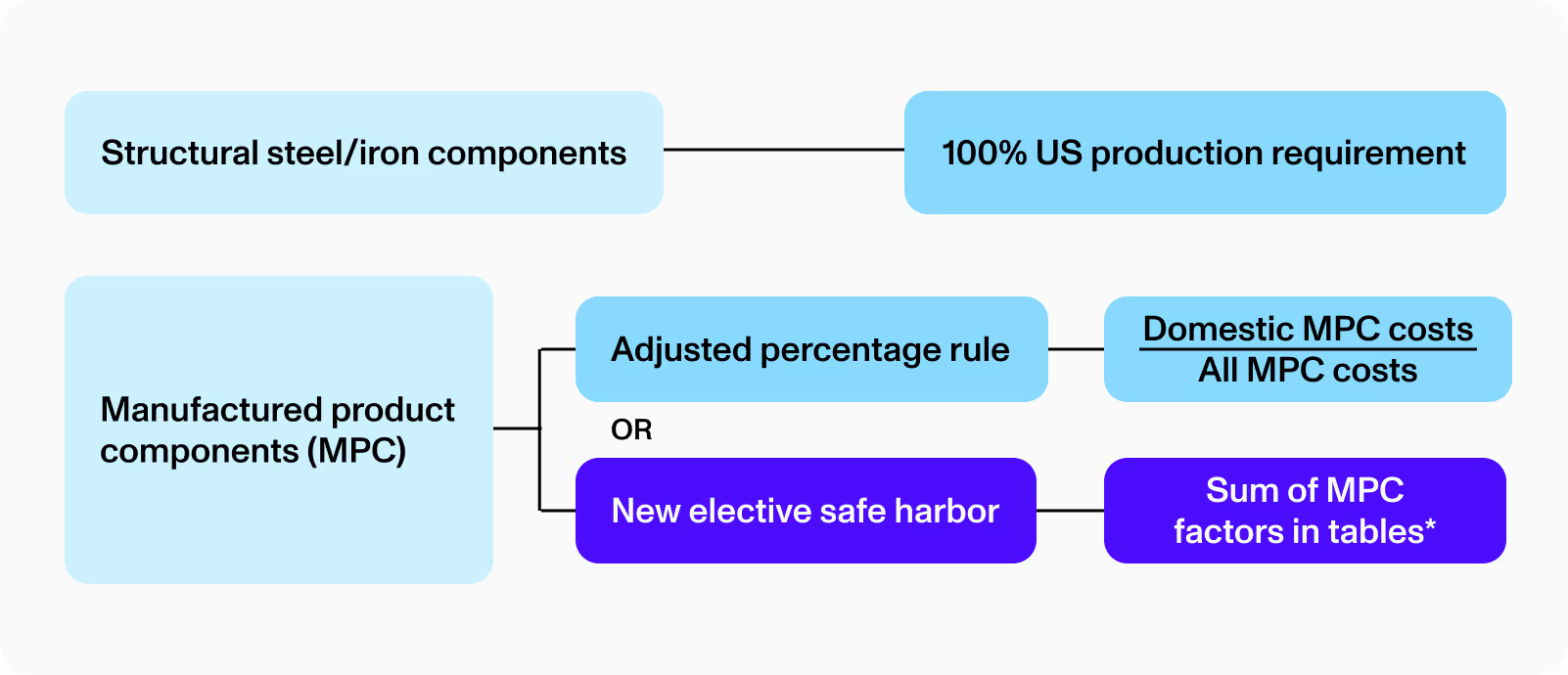

To qualify for the DC bonus, a project must meet two sets of criteria: one for manufactured products and one for steel and iron.

Structural steel and iron components — materials that are integral to the project structure — must be sourced entirely in the US.

Manufactured products and components (MPC) must meet the adjusted percentage rule based on the MPC costs. If the share of domestically produced and sourced components relative to total MPC costs is equal to or greater than the required adjusted percentage, then the project can qualify for the DC bonus adder. The adjusted percentage rule increases from 40% for projects beginning construction prior to 2025 (or 20% for offshore wind projects) to 55%, according to the following schedule:

Aggregating data to qualify for the adjusted percentage rule threshold has been a challenge for some projects, and so the elective safe harbor is meant to offer a simpler pathway for projects to demonstrate that they qualify for the DC bonus. The figure below illustrates how the new safe harbor fits into the overall DC bonus qualification rubric.

Qualification for the domestic content bonus

The safe harbor allows projects to substitute the IRS’ calculated factors for MPCs in lieu of independently calculating the MPC manufactured cost. Projects still have an obligation to purchase domestically produced materials, and would discount the MPC factor proportionally if not all of the supplied product came from a US manufacturer.

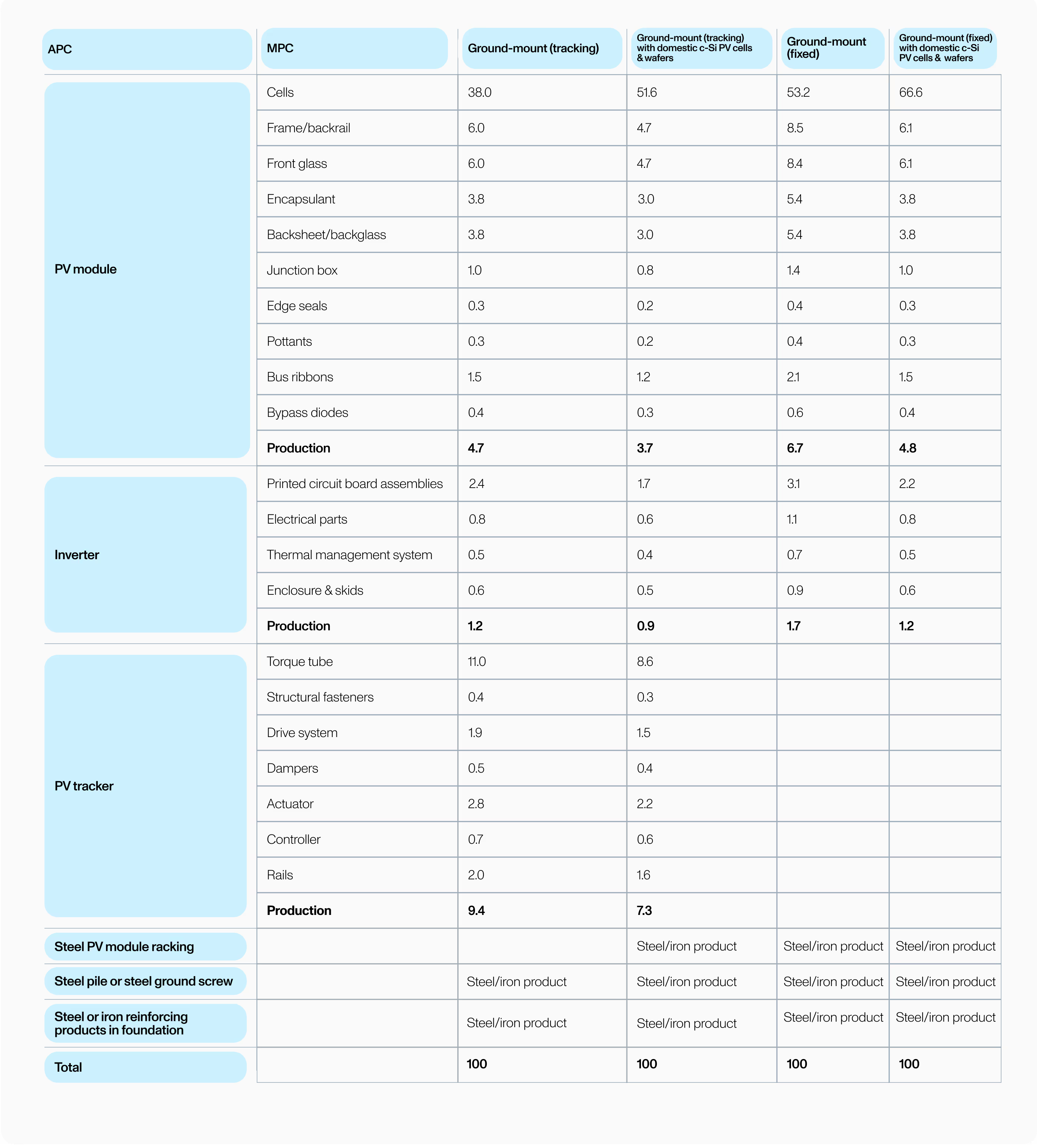

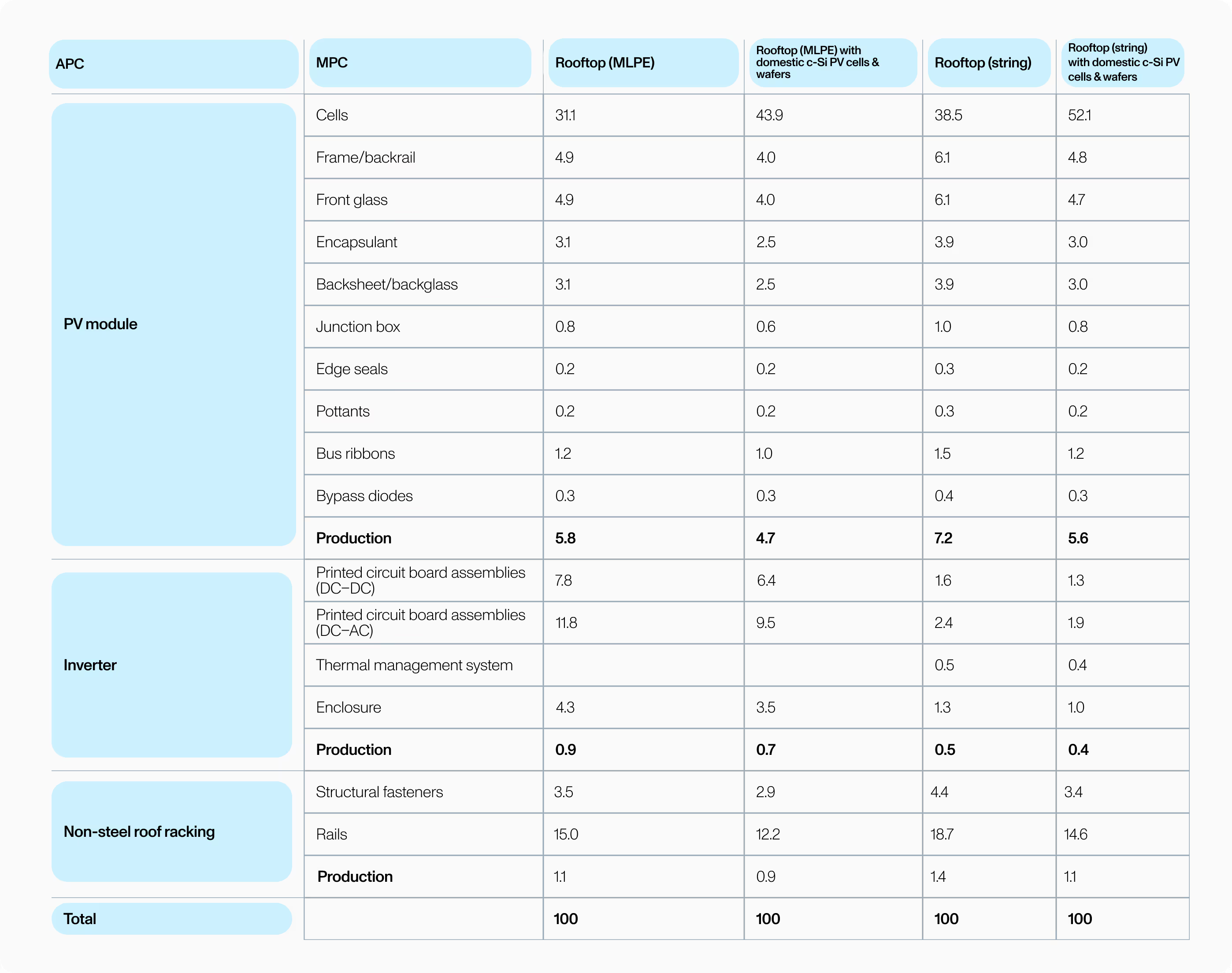

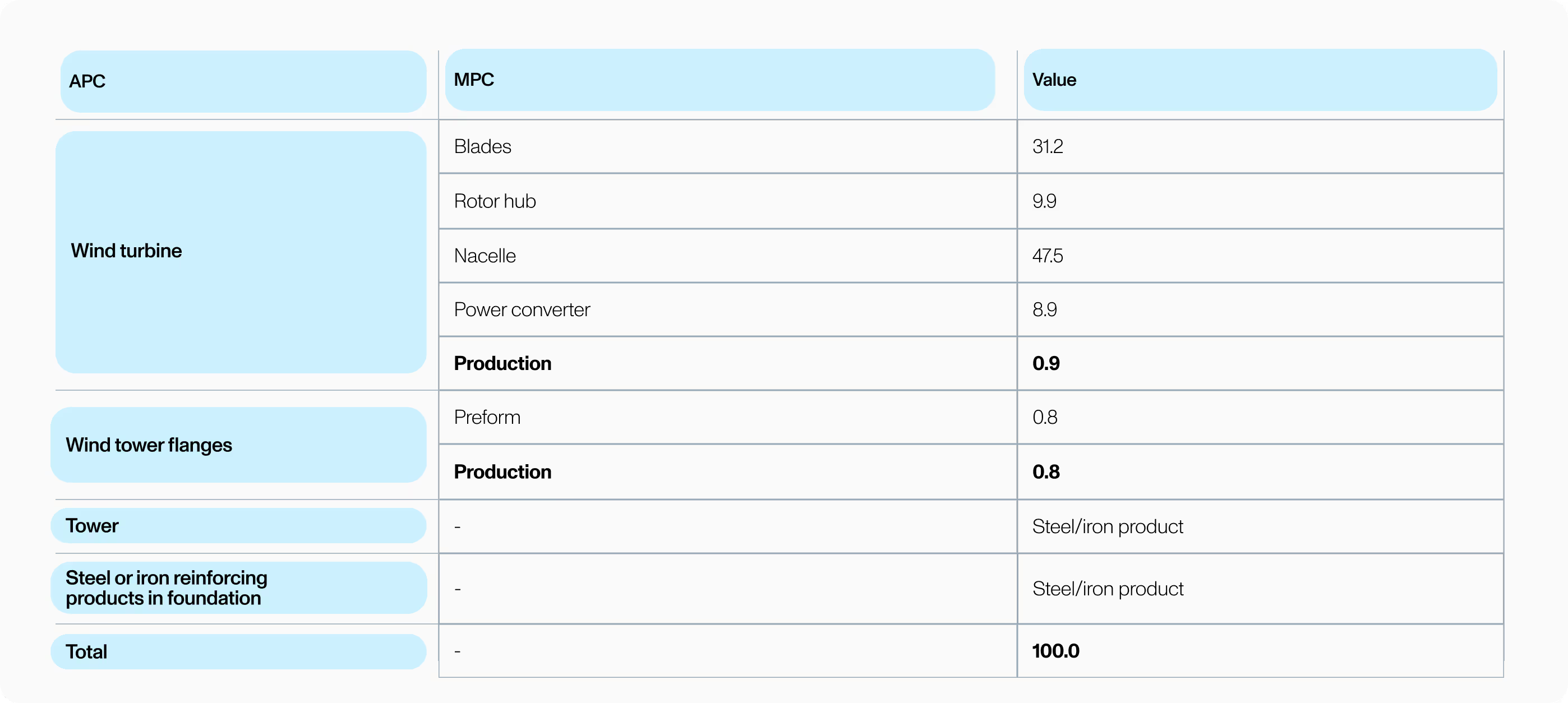

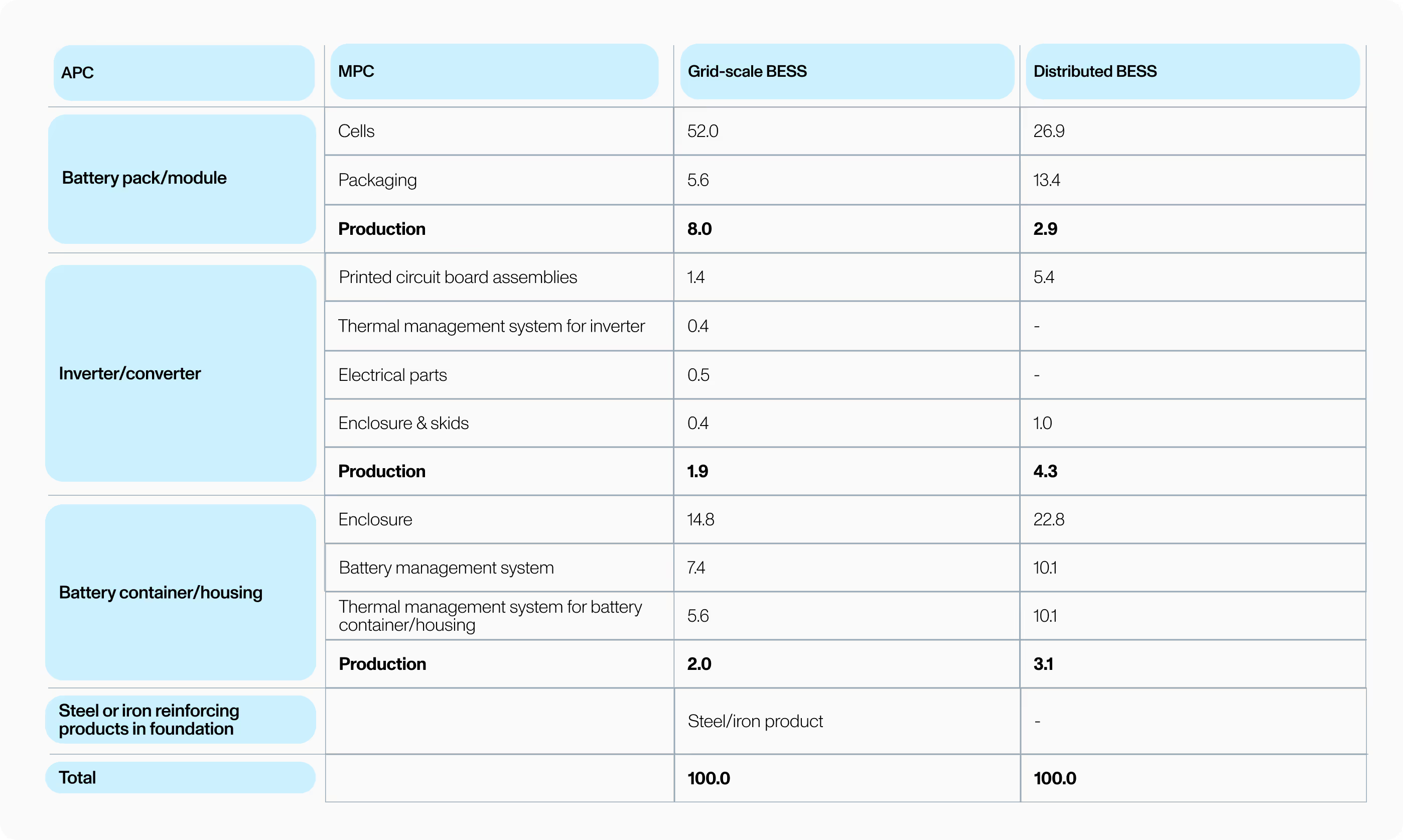

The IRS published tables containing MPC factors for different solar PV installations, onshore wind, and BESS. To determine whether a project meets the requirements of the DC bonus, a project developer would first need to determine that all structural steel and iron was produced by a US manufacturer. Then, using the factors in the IRS tables, it could determine whether its share of MPCs exceeds the percentage threshold (40% in 2024 for solar, onshore wind, and storage in 2024).

For each technology type, the tables include a list of MPCs as well as applicable project components (APCs) and the associated factors. For each MPC, developers should determine whether:

For all MPCs that satisfy the above criteria, the project will sum up the factors in the appropriate table to arrive at the domestic content percentage. If that value exceeds 40%, then the project can demonstrate that it qualifies for the DC bonus. If all of the components in a given APC category are manufactured in the US, the IRS provides an additional “production” factor that is additive to the domestic content percentage calculation.

IRS Notice 2025-08 updated table for solar PV ground-mount

Updated table for solar PV rooftop

Updated table for land-based wind

Updated table for battery energy storage system (BESS)

All of these projects would meet the domestic content requirements to claim the DC bonus as long as they are also able to demonstrate that the structural steel/iron used in the facility are 100% domestically sourced, as well.

The First Updated Elective Safe Harbor notice renamed and clarified several APCs and MPCs including in the May 2024 notice to better reflect component functions and/or the manufacturing process and supply chain. Some tables also include updated cost percentages.

The biggest change is to the solar PV table. Notice 2025-08 splits the original Table 1 for Solar PV into two tables: one for ground-mount photovoltaic systems and one for rooftop photovoltaic systems. Each of the two tables also contain additional columns for PV systems with domestic c-Si PV cells and domestic wafers. These columns came in response to comments the IRS received highlighting the expected cost premium of utilizing domestically produced c-SI PV cells made with domestically produced silicon wafers.

The notice also clarifies that a qualified facility or energy project placed in service after December 31, 2022 (for projects claiming the legacy PTC or ITC) or December 31, 2024 (for projects claiming the tech-neutral §45Y or §48E) and that meets the 80/20 Rule can use the classifications and cost percentages in the First Updated Elective Safe Harbor notice or Table 1 in Notice 2024-41 to qualify for the DC bonus credit amount. According to the 80/20 Rule, retrofitted facilities can be treated as new facilities provided 80% of their components are new; fair market value for the reused equipment cannot exceed 20%.

Many projects may find that they are newly able to demonstrate that they qualify for the DC bonus and may wish to take advantage of the opportunity to transfer these credits. Get in touch with us today to explore the market for clean energy tax credits.