Much has been written about the benefits of tax credit transfers following the passage of the Inflation Reduction Act (IRA), but questions remain as to how to actually effectuate a transfer. Crux had the opportunity to partner with Vinson & Elkins tax experts Lauren Collins and Viki Vozarova to prepare this detailed guide to accessing and navigating the Internal Revenue Service's (IRS) pre-filing registration portal, an essential step in every transferable tax credit deal.

Lauren and Viki are leaders in clean energy tax and renewable energy project finance. They shared their insights into the pre-filing portal, the rules governing pre-filing registration, and the proper way to account for transferable tax credit deals in tax filing.

This how-to guide provides market participants with:

Tax credit pre-filing registration is a requirement for making a transfer of an eligible tax credit. A transfer will not be effective unless the transferor taxpayer (i.e., the seller) receives a valid registration number for each “eligible credit property.” Both the seller and the transferee taxpayer (i.e., the buyer) must include such registration number(s) on the transfer election statement filed with each party’s US federal income tax return.

The IRS administers the registration process through its portal and recommends that entities register any facilities for which they intend to transfer (or have transferred) tax credits. Registration is also required for taxpayers who intend to claim an elective payment (i.e., “direct pay”), but this guide only addresses transfer transactions.

The first step for a project seeking to register its tax credits through the pre-filing registration portal is to create an account for the transferring taxpayer (more information on determining the transferring taxpayer is included in the FAQ section). Companies must:

Timing of the registration can be challenging. The IRS only allows one registration package per taxpayer per year to be open and requires that the property/facility is placed in service before the taxpayer completes the pre-registration process. The IRS directs taxpayers to allow approximately 120 days for registration numbers. In practice, this process has often been quicker, but companies may need to correct or amend parts of their filing and should plan for ample time.

There are several points that companies should be aware of to ensure that their applications are timely and successful:

The transfer election statement is a statement that describes the transfer of a credit between a seller and a buyer. It must be attached by both the seller and the buyer to their respective tax return.

According to the US Department of the Treasury’s final regulations governing the transfer of clean energy tax credits, the following information must be included on a transfer election statement for each piece of energy property/facility:

Beyond what is outlined in the above requirements, the form of a transfer election statement is not explicitly dictated in the Treasury Regulations. As a result, opinions among counsel and accounting firms differ on whether a separate signed transfer election statement is required for each energy property or facility, or if a schedule listing multiple eligible credit properties with registration numbers can be included in a single transfer election statement. Some accounting firms also have preferred forms of transfer election statements they may require their clients use.

To ensure timely filing, the transfer election statement must be completed before the earlier of when the seller or buyer files their tax return — meaning that the seller must have received the registration number(s) associated with the transferred credits before this date.

In addition to completing the pre-filing registration process and preparing the transfer election statement, sellers have several other tax filing requirements to ensure a successful tax credit transfer.

A transfer election must be made as part of the annual (or short period) tax return filed before the due date (including extensions) for both the seller and buyer. The IRS has been clear that the transfer election cannot initially be made on an amended tax return for the seller. Once a return is filed, a taxpayer typically cannot change (or add) a credit transfer, but they may be able to make corrections for typos.

A corporate taxpayer is required to file its annual tax return by the 15th day of the fourth month following the close of its taxable year (e.g., April 15 for calendar-year corporate taxpayers). Partnerships (including multi-member LLCs) and S-Corps typically have a filing deadline of March 15, unless they operate on a fiscal year, in which case, the filing deadline will be the 15th day of the third month following the close of its taxable year. However, corporate and partnership taxpayers usually extend their filing deadline until the ninth or tenth month following the close of their taxable year (i.e., September for calendar-year partnerships or October for calendar-year corporations).

When filing the tax return, both the seller and the buyer participating in a tax credit sale transaction must include the following documents:

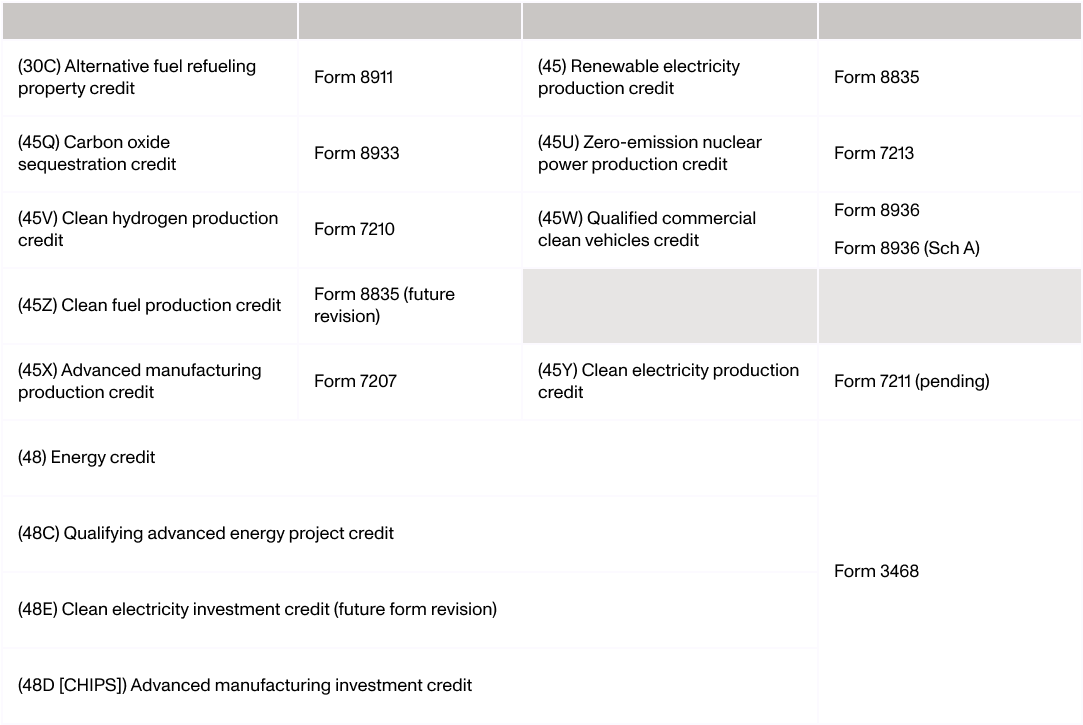

Source credit forms

Generally, any US taxpayer that is otherwise eligible to claim certain clean energy incentives, except for certain tax-exempt, not-for-profit, or governmental organizations.

Generally, any US taxpayer that is unrelated to the credit seller and that has a tax liability that it may offset with purchased tax credits. Corporations are presumed to be able to use tax credits toward their federal tax liabilities. Passive activity rules govern whether partnerships, S-corps, and individuals may use tax credits against their tax liabilities.

The transferor taxpayer (the taxpayer entitled to sell tax credits) is generally the regarded taxpayer (for US federal income tax purposes) that would otherwise be able to claim the tax credit as a credit against its tax.

If a C corporation directly holds a facility or property for which an eligible credit is determined, the C corp is treated as the “transferor taxpayer,” and the election to transfer an eligible credit is made at the C corp level.

If a partnership or an S corporation directly owns a facility or property for which an eligible credit is determined, the partnership or S corp is treated as the “transferor taxpayer,” and the election to transfer the eligible credit is made at the entity level, not by the individual partners or shareholders. Put differently, if a partner wants to transfer credits that would otherwise be allocated to the partner, the partner must direct the partnership to effectuate the transfer.

If the property is held by an entity that is disregarded for US federal income tax purposes (i.e., a disregarded entity — typically, a single member LLC that has not elected to be taxed as a C corp), the first taxable entity up the chain of ownership that is regarded for US federal income tax purposes is treated as the “transferor taxpayer”.

The transfer election would be made in connection with a C corp’s annual Form 1120, a partnership’s annual Form 1065, or an S corp’s annual Form 1120-S, as applicable.

It is not a requirement that a transferor taxpayer/seller obtain a pre-registration number prior to entering into an agreement to sell tax credits to a transferee taxpayer/tax credit buyer. However, buyers and sellers of tax credits must file a transfer election statement with their annual tax filings, and they must obtain a pre-filing registration number to complete the transfer election statement. As such, some parties may negotiate for a registration number by a particular date or milestone.

The pre-filing registration portal has not historically been open for applications for much of the year, so projects placed in service before the portal is open have often been funded without the pre-filing registration number being generated. However, some parties may require a registration number by a particular date or milestone.

The portal is currently accepting applications for tax credits that have been generated in 2023, 2024, or 2025. Tax credits must already have been generated — a project must be placed in service or a facility must have generated tax credits through operation — to submit an application for pre-filing registration to the IRS. In 2023 and 2024, the IRS opened the portal for applications in the third quarter related to registration for those tax years. In 2025, the portal began accepting applications for pre-filing for 2025 vintage-year tax credits in the second quarter. Crux anticipates that the portal will accept applications for pre-filing registration for 2026 vintage tax credits in early 2026.

Projects that are expected to enter service in the future must apply for pre-filing registration after they have been placed in service.

The IRS encourages applicants to allow 120 days to obtain a pre-filing registration number, but, in practice, the time period required to receive the registration number tends to be much shorter (typically, around six weeks). However, applicants are regularly asked to amend their registration application or correct missing/inaccurate information. Any amendments required can extend the time required to obtain the pre-filing registration number (though the IRS has indicated that timely amendments may not result in the applicant losing their place in the queue).

The IRS has made accommodations for applicants that need to obtain a pre-filing registration number quickly. The IRS has a priority contact email (irs.elective.payment.or.transfer.of.credit@irs.gov) that parties can reach out to if they are approaching the tax-filing deadline and have not received their pre-filing registration number. The IRS also recommends that parties reach out through the Secure Messaging feature within their IRS portal during business hours for quicker response times. Taxpayers should not rely on these priority channels, but they may help a taxpayer receive their pre-filing registration number on an expedited basis under certain circumstances.

Typically, sellers of credits will provide a covenant to obtain a pre-filing registration number by a certain date or milestone. In that way, the failure to obtain the pre-filing registration number would constitute a violation of the deal covenants (i.e., the same indemnification or remedies that are applicable to all other covenants of the seller would be available to the buyer).

Each piece of energy property or facility generally must obtain a pre-filing registration number. However, the IRS allows applicants to batch a portfolio of energy facilities together when making their application for pre-filing registration and, in some circumstances, allows multiple energy properties to be combined as a single “project” and receive one registration number.

There is no limit to the number of projects that can be included in a pre-filing registration application. However, a taxpayer may only have one open application at any one time and cannot include additional projects until the application has been returned to the taxpayer.

There is no definitive answer as to whether individual transfer election statements are required for each piece of energy property/facility or whether a portfolio of projects can be packaged together on a single transfer election statement — different advisors take different views of the question. The IRS requires that the transfer election statement include, at minimum, the following information for each piece of energy property/facility:

No. The receipt of a pre-filing registration number does not mean that a project is eligible for a certain tax credit, that the project’s tax credits are properly calculated, or that the tax credit will not be subject to audit. Buyers must conduct their own due diligence on the tax credits they purchase.

For more information about tax credits, check out our guide to transferable tax credits. With our large, liquid marketplace, Crux makes it easy for tax credit buyers and sellers to transact with efficiency and transparency. To list your credits or get started on the platform, get in touch.