An agreement reached in summer 2021 among OECD member nations created a framework for a global minimum corporate tax rate of 15%, a structure termed “Pillar Two,” to prevent tax base erosion and profit shifting by MNEs. Such global anti-base erosion rules are often abbreviated to “GloBE” in the OECD’s parlance.

Beginning in 2024, under Pillar Two, MNEs will be required to pay taxes of at least 15% in each jurisdiction where they operate; if this threshold is not met, they may be subject to “top-up taxes” by a separate jurisdiction.

Following the passage of the IRA in the US, MNEs have sought additional clarification on how the tax benefits of newly established transferable tax credits would be treated for purposes of ETR calculations for US operations under Pillar Two.

On July 17, 2023 the OECD issued guidance confirming IRA transferable tax credits will receive beneficial treatment under Pillar Two, which is an enormous win for MNEs operating in the US. As summarized below, the guidance established a special regime for “transferable tax credits” (most comparable to the existing category of “refundable credits”) that will ensure transferable tax credits have a less dramatic impact on the calculation of overall ETR than could otherwise be the case. Specifically, under this transferable tax credit regime, IRA transferable tax credits are classified as “marketable transferable tax credits” (MTTCs) in the hands of the taxpayer who generated them (regardless of whether or not such MTTCs are actually sold) and as “non-marketable tax credits” (NMTTCs) in the hands of a buyer.

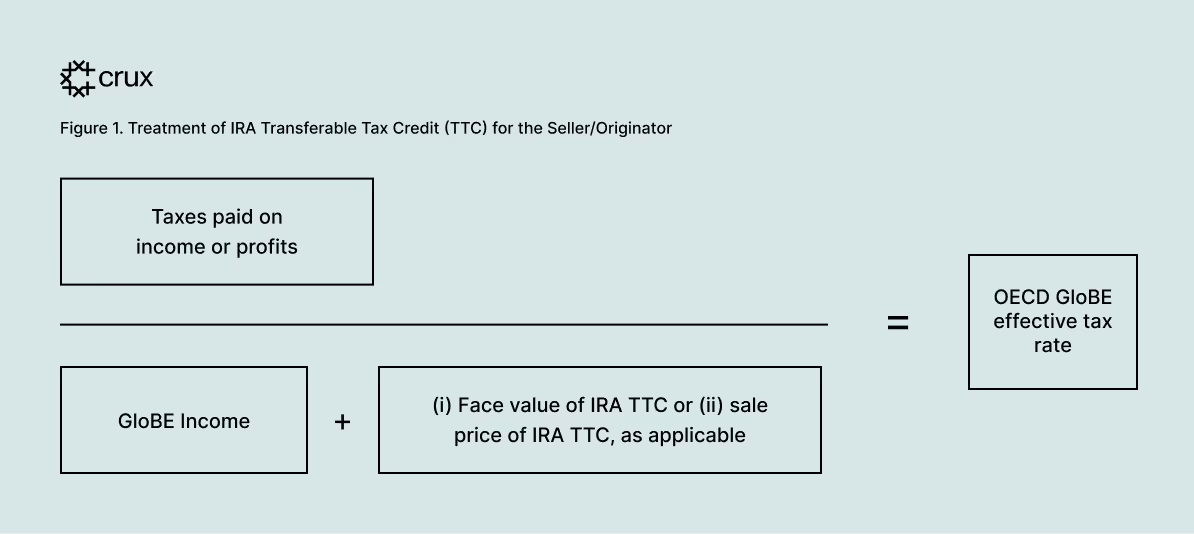

As illustrated in Figure 1 below, MTTCs are treated as giving rise to additional pre-tax income for the taxpayer generating the tax credits (e.g. the developer or seller) equal to the value realized, effectively increasing the denominator for purposes of calculating overall ETR. In general, a developer that generates –– but does not sell –– tax credits would recognize an increase in pre-tax income equal to the entire face value of the unsold tax credits.

In contrast, a developer that generates and sells tax credits (typically at a discount to the face value) would only recognize an increase in pre-tax income equal to the sale price (i.e. the amount a buyer paid to purchase the tax credit).

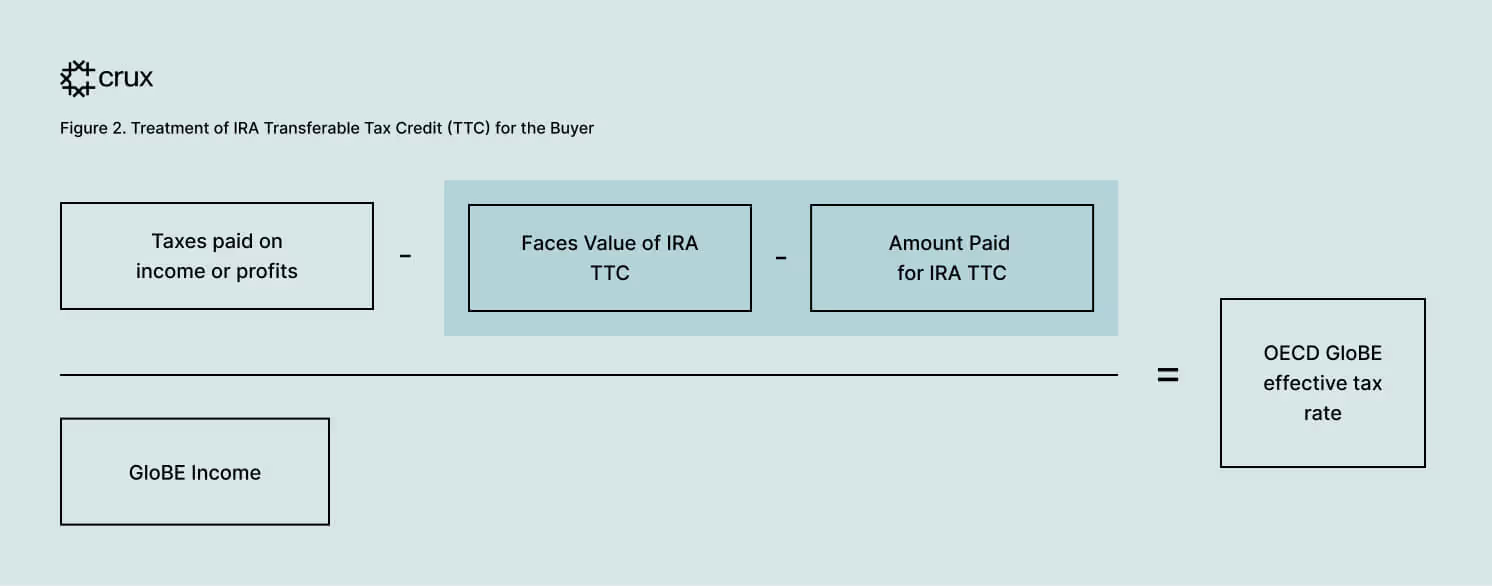

In the case of an NMTTC, as illustrated in Figure 2, only the discount between the face value of the transferable tax credit and the purchase price will be deemed a reduction in taxes paid for purposes of calculating the buyer’s overall ETR. To the extent an MNE’s US ETR is reduced below the globally agreed minimum of 15%, the MNE could still be subject to “top-up taxes” outside the US.

As an example, if a transferable tax credit with a face value of $1.00 is sold for $0.90, (i) the seller would recognize $0.90 of pre-tax income, and (ii) the buyer would be deemed to have a reduction in taxes of $0.10.

With the OECD’s guidance, we expect MNEs will feel increasingly comfortable participating in the transferable tax credit market, both as buyers and sellers of tax credits. Crux helps clients navigate the complexities of the market with a suite of tools designed to streamline transactions, reduce risk, and access a growing ecosystem. Developers on Crux more easily find buyers at better prices. Buyers have access to more credit opportunities with more transparency on the market. Financial institutions and other intermediaries leverage tools to scale and streamline their syndication businesses. If you’re ready to get started, get in touch today.

Crux does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on as, tax, legal or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.