The market for §45Z clean fuel production credits (PTCs) is in its early stages. Created by the Inflation Reduction Act (IRA) in 2022, the §45Z credit was designed to incentivize domestic production of low-carbon transportation fuels.

While the US Department of the Treasury and the Internal Revenue Service (IRS) have yet to release final guidance on §45Z credits, initial guidance released in January 2025 has clarified important questions and opened the door for more clean fuel credits to start transacting in the tax credit market. Treasury released further proposed regulations implementing the §45Z clean fuel production credit on February 3, 2026. A public comment period will run through April 5, 2026.

Get our latest insights and favorite reads on the transferable tax credit market in your inbox.

The §45Z credit covers a range of clean fuel types that are produced domestically and sold for use in transportation.

Organic matter from agricultural waste, municipal solid waste, and wastewater can be transformed into renewable natural gas (RNG) that goes into compressed natural gas (CNG) to fuel vehicles. RNG, which can be integrated into natural gas pipelines, is produced using anaerobic digestion. Organic waste is put in sealed tanks where microorganisms break down the organic matter and produce raw biogas, which is a mixture of methane, carbon dioxide, and other trace gases. The raw biogas is then processed and upgraded to produce RNG.

While RNG is made with organic matter, biodiesel uses vegetable oils or animal fats as feedstock. A chemical process called transesterification occurs when the animal fats or vegetable oils react with alcohol and a catalyst — usually sodium hydroxide or potassium hydroxide — to produce biodiesel and glycerin. As the name implies, biodiesel can be used to power diesel engines, and is typically blended with hydrocarbon-based diesel fuel.

Produced primarily through hydrotreating, renewable diesel uses feedstocks such as soybean and canola oil, animal fats, used cooking oils, and inedible corn oil. The hydrotreating process involves treating feedstocks with hydrogen at high temperatures and pressures in the presence of a catalyst. The process removes oxygen and creates a pure hydrocarbon chemically identical to petroleum diesel. This allows it to be used as a replacement fuel or a drop-in fuel, either at 100% concentration or blended in any proportion in existing diesel engines without modification.

Sustainable aviation fuel (SAF) is also chemically like conventional jet fuel, although it is made using renewable feedstock and has significantly fewer lifecycle greenhouse gas emissions. Several methods are used to produce SAF:

Besides serving as a feedstock for SAF, ethanol can also be blended into gasoline to reduce emissions. Used in flex fuel vehicles, ethanol blends range from 10% to 85%. Corn is the main feedstock for ethanol fuel in the US. It is produced by fermenting the feedstock with yeast, which converts sugars into ethanol and carbon dioxide. The carbon intensity of ethanol can be reduced by integrating carbon capture and storage (CCUS) at ethanol production plants and by implementing sustainable agriculture practices to cultivate corn and other feedstocks.

While not yet commonly produced as a clean fuel, hydrogen is an eligible fuel type. To qualify for the §45Z credit, hydrogen must be sold for use as a transportation fuel. Clean hydrogen used for other purposes can currently qualify for tax credits under the §45V credit.

Hydrogen can be produced from diverse feedstocks including fossil fuels (e.g., natural gas, coal), biomass, and water.

The §45Z credit is unique in that it is a performance-based incentive. Unlike fixed-value tax credits such as the §45X advanced manufacturing credit, the value of a §45Z credit depends on how much a fuel reduces lifecycle greenhouse gas emissions relative to a petroleum baseline. Fuels with very low or zero emissions can earn up to $1.00 per gallon (or gallon equivalent), while those with higher emissions receive a proportionally smaller credit. This structure rewards innovation and favors fuels that deliver the greatest emissions reduction, but also requires rigorous documentation and modeling to validate emissions intensity.

To qualify for the credit, fuels must have lifecycle greenhouse gas (GHG) emissions below 50 kilograms of CO2 equivalent per million BTUs (kg CO2e/mmBTU). In January 2025, the IRS issued Notice 2025-11, specifying the use of the 45ZCF-GREET model developed by Argonne National Laboratory as the primary methodology for calculating lifecycle GHG emissions to determine the credit amount for most fuels. The notice includes emissions tables; fuels and production methods listed in the table can use the published emissions rate directly.

If a fuel type is not listed in the published emissions rate table, the producer must apply for a provisional emissions rate (PER), supported by a GREET-based lifecycle analysis. This ensures the credit amount aligns with the measured emissions profile of the fuel.

This distinction is critical because it determines whether a project can rely on predefined values or must develop and substantiate custom emissions modeling to claim the credit.

The credit amount is calculated using the following formula:

Credit per gallon (or gallon equivalent) = $1.00 × (1 – (Fuel GHG emissions ÷ 50))

Section 45Z credits differ from traditional renewable energy sectors such as wind and solar. As discussed above, the clean fuels credit is production based versus a fixed credit amount. Another primary difference is the underlying asset: §45Z credits are tied to feedstock production. This exposes buyers to commodity risks, especially for crop-based biofuels. If a dairy supplying feedstock for RNG goes out of business, for example, finding an immediate replacement feedstock source can be challenging. It’s important to note that buyers do not take on a risk that they will have to buy credits that are never generated; the risk is limited to not receiving anticipated credits.

Clean fuel credits are expected to follow a "book and claim" system, in which the environmental attributes of the fuel are tracked and verified independent of the physical molecules. This allows for a more flexible, paper-based transaction, where the credit is verified based on actual production, even if the molecules aren't physically traced. The IRS is expected to release more detailed guidance on verifying credits in the near future.

For buyers, the attractiveness of §45Z credits stems from two main factors:

The market for §45Z credits is still nascent, in part due to the absence of final guidance from the IRS. In 2024, only investment tax credits (ITCs) related to biofuels projects had entered the market, representing a small share (3.5%) of the total market. Crux anticipates significant growth in the demand for §45Z tax credits once regulatory clarity is firmly established.

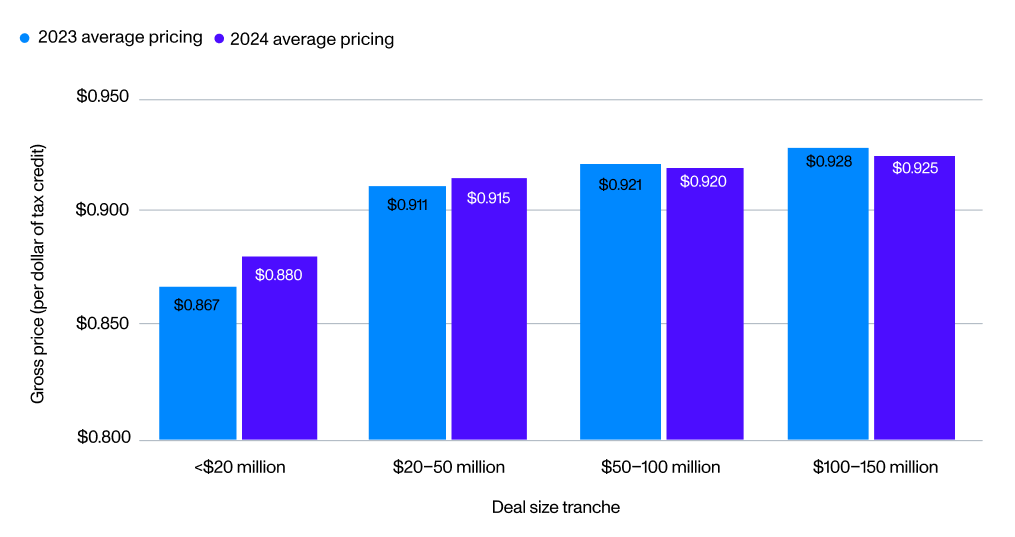

Crux’s 2024 Tax Credit Market Intelligence Report found that pricing on biogas ITC deals was steady across 2024 and stayed largely consistent with 2023 average pricing. The highest end of the market typically transacted around $0.92–0.93, with the lowest end of the pricing curve in the high $0.80s.

Biogas ITC pricing by deal size tranche, year over year

Buyers of §45Z credits might face a more complex due diligence process given the sector’s reliance on agricultural commodities and diverse production technologies. Key due diligence areas include:

In part because of these risks, insurance is very common in biogas transactions. In 2024, virtually all biogas deals included a full-wrap insurance policy. With more §45Z credits transacting in 2025, Crux expects a clearer picture of insurance trends around this credit category to emerge.

As noted above, §45Z tax credit buyers face no financial exposure to tax credits that are never generated.

The future of §45Z credits is closely tied to ongoing regulatory developments. The IRS is expected to issue final guidance about the credit following a comment period on initial guidance released in January 2025. The uncertainty regarding guidance has made financial modeling tricky for sellers, but the market should start to see more transactions with the publication of final guidance.

Clean fuels also enjoy broad bipartisan support in Congress. The One Big Beautiful Bill Act signed on July 4, 2025 extends the sunset date for §45Z credits by two years, from 2027 to 2029. The final bill also retained favorable changes to feedstock and emissions rules, including limiting the origins of feedstock to the US, Mexico, and Canada and clarifying that emissions attributed to indirect land-use change will not be counted.

Crux expects to see more §45Z transactions on the market this year, pending final guidance from the IRS. Overall, demand for production tax credits is expected to rise in the second half of the year.

Get in touch to learn more about buying tax credits on the Crux platform.

© 2025 Crux Climate, LLC All rights reserved

228 Park Ave S PMB 72363, New York 10003-1502

Securities are only offered through Crux Capital Securities, LLC, a member of FINRA and SIPC. Crux Capital Securities, LLC is a broker-dealer registered with the SEC and various states.