Domestic clean energy manufacturing capacity is booming due to the tax incentive for manufacturing solar, wind, or battery components, inverters, and critical minerals. Manufacturers of these products are entitled to receive advanced manufacturing production tax credits (AMPTC), also known as §45X tax credits, which can be sold for cash through a provision in the tax code known as transferability.

The market for transferable tax credits is growing and maturing rapidly, and §45X tax credits are among the market's most popular and easily transactable. Understanding how §45X tax credits are calculated, claimed, and sold can help US manufacturers efficiently realize the benefit of this impactful tax provision.

Table of contents:

The §45X tax credit, created by the Inflation Reduction Act (IRA) and modified in the One Big Beautiful Bill (OBBB), provides a tax incentive for domestic manufacturers under Section 45X of the Internal Revenue Code (IRC). The AMPTC incentivizes domestic production of certain clean energy components and critical minerals. This production tax credit (PTC) is assessed based on the volume of eligible products manufactured.

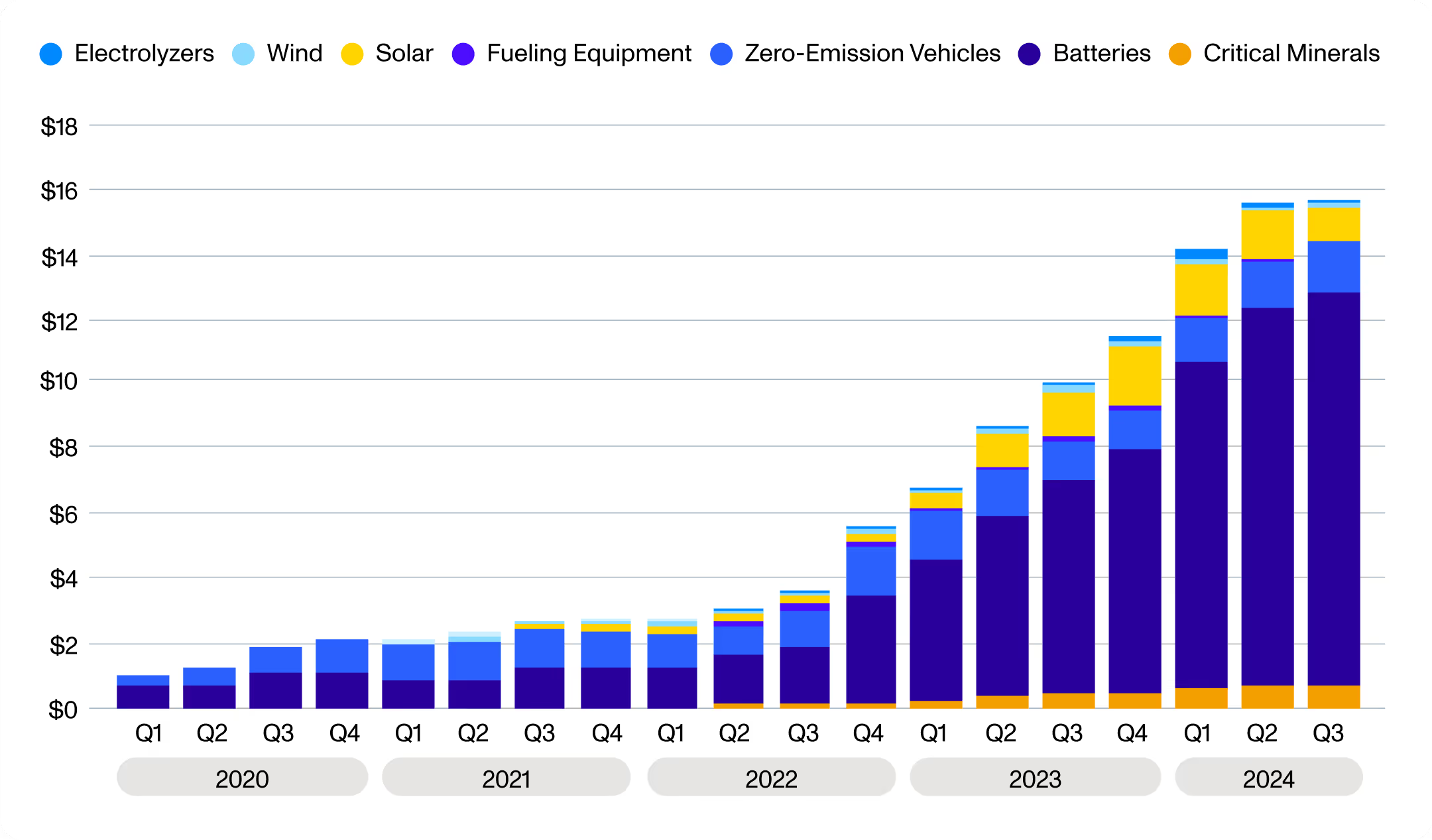

The §45X credit is a powerful incentive for domestic manufacturers. Clear visibility into the value of the credit over the next decade supports long-term investment decisions. According to data from the Clean Investment Monitor (CIM), investment in manufacturing has increased 305% since 2022, from $22 billion in 2020–2022 to $89 billion in 2023–2024.

Manufacturing investment by technology, quarterly (billion 2023 USD)

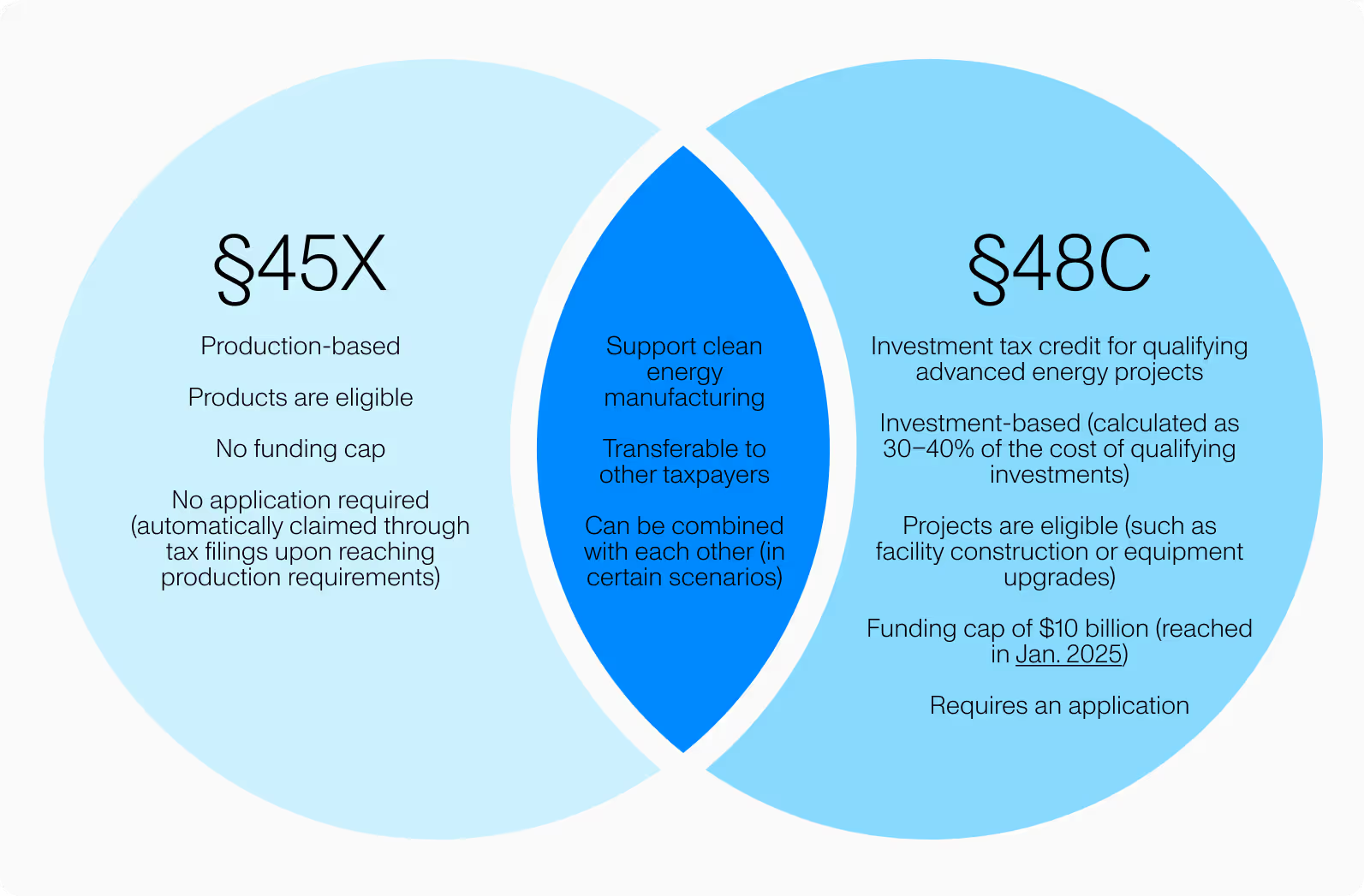

There are two different types of advanced manufacturing tax credits: §45X credits and §48C credits. Here’s how they compare:

Facilities that received an award under the §48C program and claimed the tax credit associated with it are not eligible for §45X tax credits. Some facilities may include multiple production lines and may earn §48C for some portion of their operations but not for the full facility operation. The portion of a facility not covered under the §48C program would still be entitled to claim §45X tax credits associated with its production through the end of 2032.

To be eligible for the §45X PTC, a producer must:

Manufacturers are entitled to receive a production tax credit if they produce:

Facilities that refine or recycle critical minerals are also eligible for the tax credit. Critical minerals are a set of 60 different minerals that the US Department of Energy, the Department of the Interior, and the US Geological Survey (USGS) deem essential for supporting clean energy. The list includes:

In November 2025, the USGS expanded the list of critical minerals to include copper, uranium, and phosphate, among others. The list of critical minerals eligible for the §45X tax credit is established in statute and not subject to change based on USGS amendments to the critical mineral list.

The final regulations as of October 2024 allow the inclusion of certain material costs for applicable critical minerals and electrode active materials.

The Internal Revenue Service (IRS) defines the process of §45X eligible manufacturing as “substantial transformation of inputs into a complete and distinct eligible component,” not simply that which would result from “minor assembly” or “superficial modification.”

Take a battery manufacturer assembling battery modules out of battery cells as an example. A minor assembly might be simply packaging pre-made battery cells without changing the cells — that would not be eligible for the tax credit. If the manufacturer integrates the cells into a new battery module with original wiring, however, that would be eligible as substantial transformation.

Finished goods must be produced in the US, but subcomponents or constituent elements (e.g., steel, framing, electrical components) do not need to be sourced in the US. However, a specified percentage of the materials that make up a finished product cannot be sourced from producers that qualify as a “prohibited foreign entity”. Additionally, manufacturers are not required to meet prevailing wage and apprenticeship (PWA) requirements common for other clean energy tax credits.

Cheat sheet: What qualifies as a prohibited foreign entity?

The manufactured component must also be sold to a third party to earn the AMPTC.

Documentation of the manufacturing process, the goods produced, and the record of sale to a third party are key to ensuring that a manufacturer can reliably calculate its AMPTC value.

The IRS defines a contract manufacturing arrangement as “any agreement providing for the production of an eligible component,” other than “a routine purchase order for off-the-shelf property.”

Take, for example, a US solar company contracting a third-party manufacturer to produce custom solar materials. Because the materials are produced to the company’s specifications and aren’t standard, off-the-shelf items, this qualifies as a contract manufacturing arrangement in which the manufacturer is entitled to the §45X credit.

However, if the manufacturer has a contract manufacturing agreement with an unrelated entity, the contracting party (the solar company) may claim the AMPTC instead.

If a contract manufacturing agreement exists, the tax credit seller (whether the manufacturer or the contracting party) should clearly document which entity is entitled to claim the AMPTC. IRS regulations require all parties to the contract manufacturing arrangement to sign a certification statement acknowledging who will claim the §45X credits and a penalty of perjury statement.

Transferring tax credits is a relatively straightforward way to maximize the value of §45X tax credits. The §45X incentive was only established in 2022, but the long-standing tax credit advisory industry has quickly embraced these credits as clear, well-constructed, and simple to diligence in the context of a transaction.

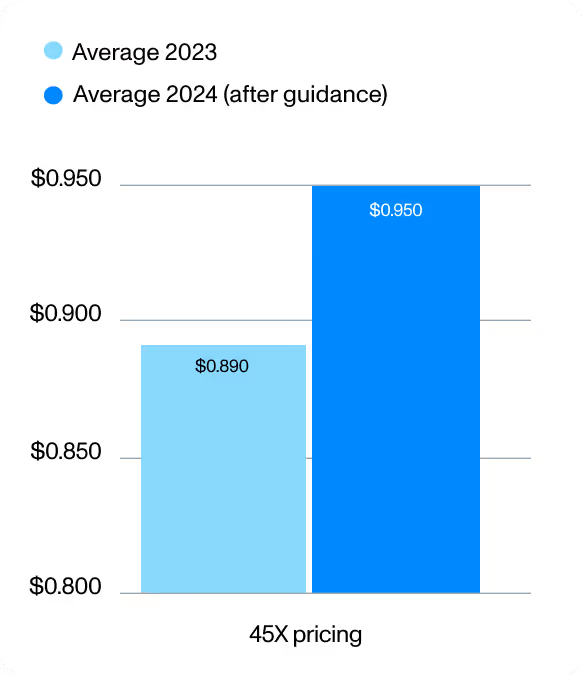

Crux has observed that the regulatory guidance published by the IRS in 2024 settled most uncertainties regarding the §45X credit. Average credit pricing observed before and after that guidance was published reflects the market’s increasing comfort and familiarity with §45X.

Average §45X credit pricing before and after release of IRS guidance

Before the release of IRS guidance, §45X credits averaged around 89 cents on the dollar in the market (an 11% discount to their face value). After the guidance’s release, credits average 93.5 cents to 96.0 cents (around a 5% discount to face value).

§45X credit deals are also quick to execute for all parties involved. Unlike other common tax credits, such as the investment tax credit (ITC), §45X credits do not incorporate the risk of future credit recapture. Once the manufacturer can demonstrate that its products are eligible for §45X credits and that the products have been sold, there is typically little doubt that it can claim and transfer the corresponding tax credit.

The simplicity of §45X contributes to the competitiveness of these credits among buyers and helps accelerate transaction timeline. Crux has observed that 30% of §45X credits listed on the platform receive bids within the first day, and 100% of credits receive a bid in the first three days after listing.

AMPTCs typically get multiple bids, as well, contributing to a seller’s ability to optimize the transaction across a range of terms – counterparty readiness to transact, timing of payment, insurance, and overall price.

Even so, it is important to approach the market with realistic price expectations. Deals with a notional value less than $50 million per year or sellers that desire a multi-year commitment from a buyer may experience less robust demand for their credits. Buyers typically expect the seller to cover the costs associated with due diligence (up to a negotiated cap) and any insurance that may be required to backstop the seller’s indemnities (or in place of indemnities).

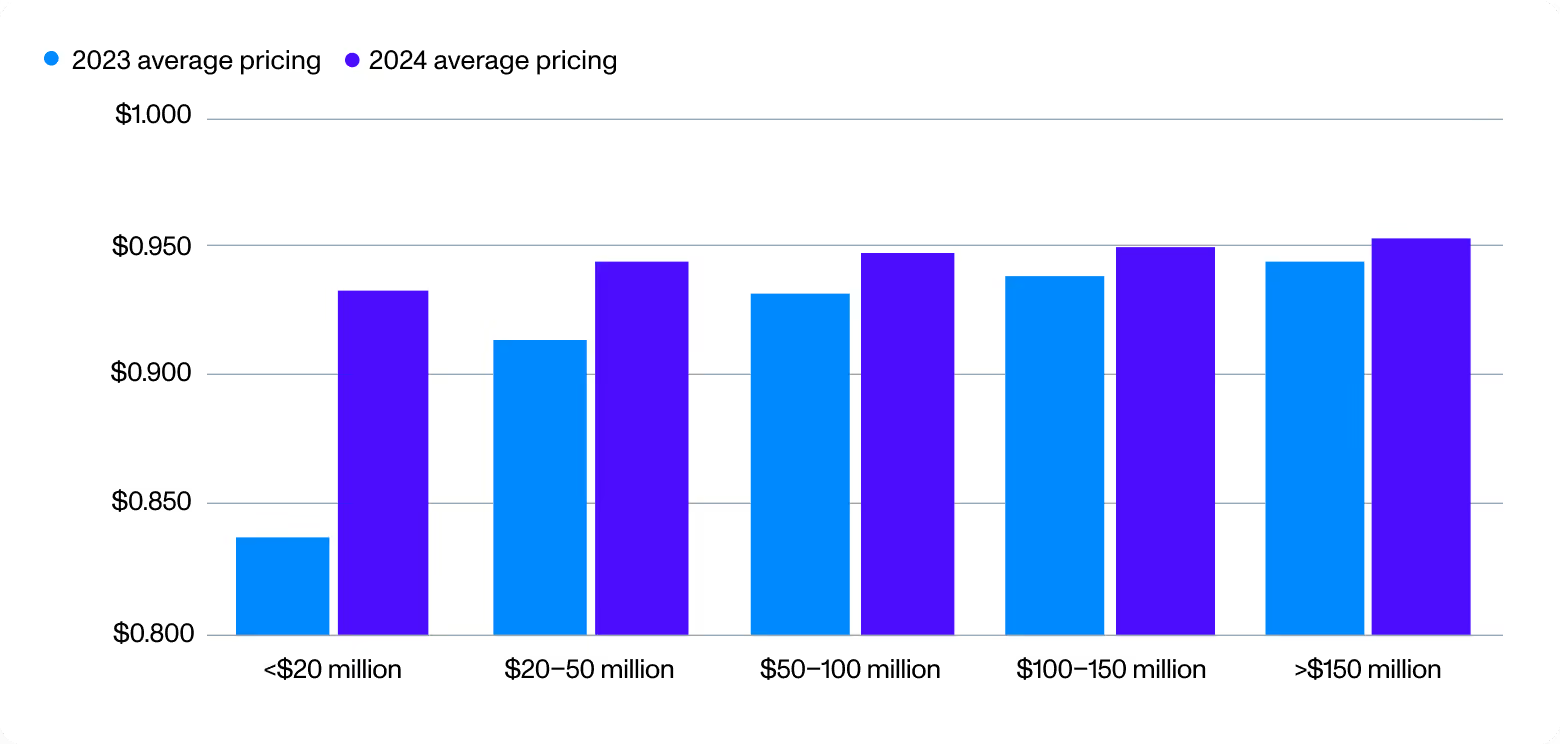

The high-water mark for pricing in the tax credit market is around 96 cents per dollar of credit. This pricing is typically realized for the largest deals, where the seller is a large company with a strong credit rating. Deals in the mid- to low 90s for §45X credits remain common.

AMPTC pricing by deal size tranche, year over year

Tax credit buyers have developed a strong appetite for §45X tax credits due to their relative abundance, simplicity, and integral role in supporting the US manufacturing industry.

The due diligence process is typically a straightforward and facts-based analysis. It has become increasingly common for manufacturers to indemnify their tax credit deals in lieu of obtaining insurance.

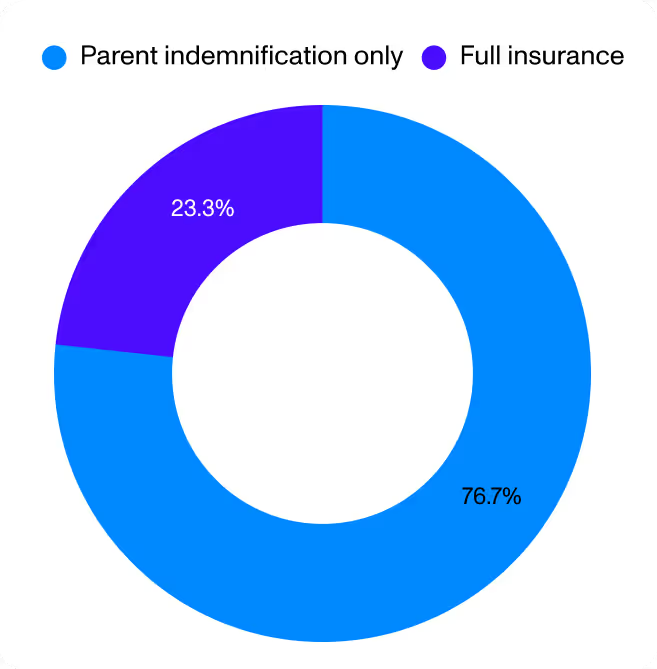

Crux has observed that in 2024, about 23% of §45X deals included insurance coverage, while 77% were indemnified by the seller parent company. Larger deals are generally more likely to include parent indemnification, as a larger entity may have sufficient balance-sheet capital to assure a buyer that it can provide a reliable indemnity.

Proportion of AMPTC deals obtaining insurance coverage, 2024

§45X PTCs are generated on an ongoing basis, and buyers have the option to contract for tax credits on a multi-year basis, also called purchasing a “strip” of tax credits. Unlike other PTCs, where buyers might contract for tax credits on a 10-year basis, two- or three-year strips are more common for §45X deals. This shorter-duration strip can be attractive to buyers who may not have a view of their future tax liabilities a decade ahead of time.

Intermediaries play an important role in facilitating tax credit transactions. It is increasingly common for sellers of §45X credits to seek multiple bids for their credits. Sellers typically indicate that they prefer counterparties who are ready to transact and who have experience dealing with §45X credits. Because advanced manufacturing is a newly eligible technology category, buyers do not necessarily have this experience.

Engaging with experienced advisors can help buyers overcome the learning curve faster, put together a competitive and timely bid for §45X credits, and demonstrate their preparedness for a transaction. Advisors and intermediaries should help their clients recognize the competitiveness of the marketplace, particularly for in-demand credits such as §45X, and encourage them to bid competitively and respond quickly to communication from the seller.

While the IRS’ final guidance on §45X tax credits in October 2024 resolved many eligibility concerns, buyers and sellers must still evaluate several important factors in the context of due diligence for a §45X deal:

Crux has prepared a proprietary due diligence checklist and workflow specifically designed to support §45X transactions. The due diligence checklist has been tested and utilized in the context of hundreds of millions of dollars worth of §45X deals, including one of the first §45X transactions and a recent transaction between Schneider Electric and Silfab Solar.

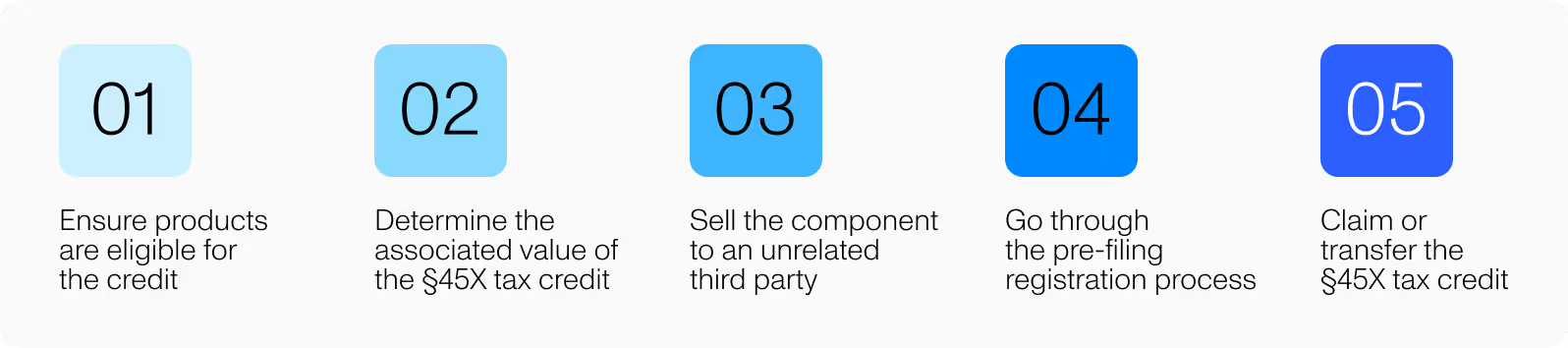

The IRS has articulated a defined tax credit value for each eligible component included in the §45X regulation. To generate the §45X credit, manufacturers must follow certain steps.

Using the previously-mentioned eligibility information, producers must carefully check that their business can use the credit.

Each §45X-eligible good has an associated tax credit value. Three primary methods are used to determine the credit rate of an eligible good:

To calculate the value of a §45X tax credit, multiply the credit rate by the production volume.

For example, say a company produces solar modules that are eligible for a $0.07 credit per watt. If it sells 10 million watts of solar modules, its tax credit will be $700,000.

For most manufactured goods, the AMPTC’s credit value phases down: to 75% of its value in 2030, 50% in 2031, and 25% in 2032. Critical minerals are not subject to the phaseout.

The §45X credit is generated and claimed annually. Manufacturers must ensure the credits claimed are tied to eligible products sold to a third party within a given year.

Products may have been produced in a preceding tax year, but until they are sold, the manufacturer is not entitled to claim a §45X credit associated with the good.

Keep these important aspects in mind when preparing to sell to an unrelated third party:

Direct pay allows entities to receive a tax credit as a cash payment as opposed to a reduction of tax liability. Therefore, if the credit exceeds your tax liability, you receive the excess as a cash refund from the IRS.

Manufacturers will calculate the total value of the §45X credits generated during a tax year and file that amount on their annual tax filings. Refunds will only be issued annually, following the receipt of the tax filing, and will not be issued quarterly following quarterly estimated return filings.

Companies are eligible to take direct pay for up to a five-year period, unless they revoke the direct pay election before the end of that period. Companies cannot re-elect direct pay after revoking that election or after the end of the five years.

While the eligible products or components must be sold to an unrelated third party to generate the tax credit, the IRS has outlined certain circumstances under which a sale to a related person may be treated as a sale to an unrelated person (the “related person election”).

Before the sale, the related person must make the election with the IRS and may be required to supply information as a condition of the election. This ensures that companies working closely together can still benefit from the credit without going through a third-party buyer.

Pre-filing registration with the IRS is a feature of both the transfer and direct pay methods of claiming the credit. The pre-filing registration portal opened in December 2023.

Companies that generate §45X credits should anticipate supplying basic facility information in the pre-filing registration portal. The IRS publishes a detailed guide describing the application process for each tax credit-eligible entity and tax credit type.

In general, the IRS recommends that applicants allow 120 days to process the pre-filing registration, though the process can be faster. At the end of the process, the IRS will supply a registration number, which is typically required in any tax credit transfer deal or direct pay filing.

Companies listing their credits on Crux can enter the pre-filing registration number and share the status of their application if the number has not yet been received.

US taxpayers who have determined they are entitled to the §45X tax credit have several options for claiming or monetizing the credit. A company intending to claim the §45X will file IRS Form 7207 with their annual return.

A separate form must be completed for each eligible facility owned or controlled by the taxpayer. §45X credits are eligible for direct pay and transferability. The credit claims process is similar in both cases, but the monetization method differs.

In both cases, the taxpayer will annually register their facility through the IRS pre-filing registration portal and indicate whether they are taking direct pay or transferring the credits.

To file for direct pay, the taxpayer must complete pre-filing registration for each facility and file Form 3800 with their annual tax return. Companies electing to take direct pay for a tax year are generally presumed to take direct pay for the subsequent four tax years unless they revoke their election and choose to transfer the credits. Once revoked, the taxpayer cannot re-elect direct pay for any remaining five-year direct pay entitlement balance.

§45X tax credits are among the most desirable and transactable tax credits in the transferable tax credit market. There are no limitations on the time period within which the company can transfer its credits — as long as the credit is generated, it can be sold in the transfer market.

Similar to direct pay, the taxpayer must complete the pre-filing registration process, file Form 7207 for each facility, and file Form 3800 with their annual returns to transfer credits.

To transfer the tax credits to a buyer, the taxpayer typically estimates their annual §45X production volume and secures a buyer directly or through an intermediary (such as a financial institution, tax firm, or transparent marketplace). The seller can ensure their credits are highly transactable by lining up due diligence items, legal memos, and sales documentation before engaging with prospective buyers.

In general, larger deals (over $50 million in annual credit volume) tend to attract the strongest pricing. It is relatively common for §45X credits to transact around 92–95% of their face value and to settle on a quarterly basis (in arrears for credits generated during the preceding quarter). Strong credit pricing and timely settlement can make transferability the most cost-effective mechanism for a company to claim its §45X credits when accounting for the time value of money.

§45X tax credits are among the most valuable and popular credits in the new transferable tax credit market. These credits support billions of dollars of new investment in US manufacturing capacity.

Transferability enables manufacturers to economically and efficiently monetize their tax credits. The diligence process for a tax credit transaction is relatively straightforward, and a deal can create a valuable and predictable source of cash flow for the manufacturer.

As you start looking into this exciting opportunity, you might want help from a qualified expert to lead you through the process. Crux successfully executed some of the first §45X transactions and continues to be a leader in developing the tax credit market.

Crux can also serve as a neutral source of information and a sounding board for intermediary parties and their clients. Our data from more than $25 billion of transferable tax credit transactions, including billions in §45X deals, provide valuable insight into pricing and commercial terms.

Want to learn even more about §45X tax credits?

Leveraging insights from Crux’s authoritative dataset on the transferability market, and Clean Investment Monitor, and the US Department of Energy, this e-book outlines everything manufacturers and buyers need to know about §45X PTCs.