Since 2023, federal legislation has allowed corporate taxpayers to purchase transferable tax credits from clean energy developers and manufacturers. Developers and manufacturers generate the tax credits from a range of qualifying projects, including traditional technologies such as solar and wind energy, as well as newly eligible technologies including advanced manufacturing, carbon capture and storage, nuclear, and geothermal. Often, however, the developer doesn’t have enough tax liability to utilize the full value of the credits.

When corporate taxpayers purchase tax credits from developers or manufacturers, the benefits are twofold:

The sale of the tax credits reduces the cost of capital for developers and manufacturers and allows them to recycle capital more quickly.

The market for transferable tax credits has grown exponentially and has spurred billions of dollars of investment into domestic energy and manufacturing projects. Demand for tax credits has increased, making the market more competitive.

This guide covers the basics of buying tax credits, including best practices for tax credit buyers.

Transferable clean energy and manufacturing credits are federal-level tax credits. They are classified as a general business credit (Form 3800). There are two categories of transferable tax credits:

Starting on January 1, 2025, the legacy investment and production tax credits supporting a set of specific clean energy technologies were replaced by new, technology-neutral tax credits. Projects that begin construction after December 31, 2024 are eligible for the §48E tech-neutral ITC and §45Y tech-neutral PTC. These credits are transferable and designed to evolve with the energy industry over the long term. Under the tech-neutral framework, it’s easier for new technologies to qualify for the investment or production tax credit.

Congress made both ITCs and PTCs transferable so that more developers and manufacturers could successfully monetize them. Tax credits are not effective if the company that earns them does not have sufficient tax liability to use them, as is often the case with energy developers and manufacturers.

Before transferability, developers relied on complicated financial transactions offered by a small group of large banks to monetize credits without directly selling them. This market — known as tax equity — was most often utilized by larger developers and investors.

By allowing project developers to sell their credits for cash to buyers seeking to offset tax liabilities, transferability makes selling and buying tax credits easier and more accessible. Crux sees tax credit buyers ranging from large Fortune 500 companies to small family offices.

For manufacturers and developers of clean energy generation, selling transferable tax credits reduces the cost of capital and enables capital to be recycled more quickly. But purchasing tax credits provides a number of benefits to corporate taxpayers, as well.

Large financial institutions enter tax equity partnerships with clean energy developers to lower their tax liability. Transferability enables a wider array of corporate taxpayers to do the same. When a taxpayer purchases transferable tax credits, they include the credit on their tax return.

The legislation allows buyers to carry credits backward and forward — if they cannot utilize the credits in their current tax year, they can carry them back up to 3 years or forward up to 22 years.

Buyers can maximize their returns by aligning funding for their transactions at or around their tax payment and filing deadlines. Buyers do not pay for credits until they are generated. However, as soon as a buyer enters into a commitment (e.g., signs a term sheet with a developer or manufacturer) to purchase tax credits applicable to a given year, they are eligible to reduce any upcoming quarterly estimated tax payments for the same year.

Increasingly, buyers are making multi-year commitments to purchase tax credits, including purchasing PTC strips, where they have predictable tax liability.

Because transferable tax credits are sold at a discount to their face value (e.g., $0.92 per $1.00 of tax credit), buyers save money compared to paying their full tax bill. Buyers that transact earlier in the year stand to benefit from larger discounts and less competition relative to transacting later in the year.

In addition, the developer or manufacturer bears most of the transaction fees, including insurance. Buyers are typically only responsible for the negotiated price.

Transferable tax credits provide buyers a simpler strategy to reduce tax liability without taking equity risk. Purchasing transferable tax credits also doesn’t involve any long-term commitment (unless a buyer elects to purchase a multi-year credit strip). In a tax equity investment, the commitment can last between 5 and 10 years.

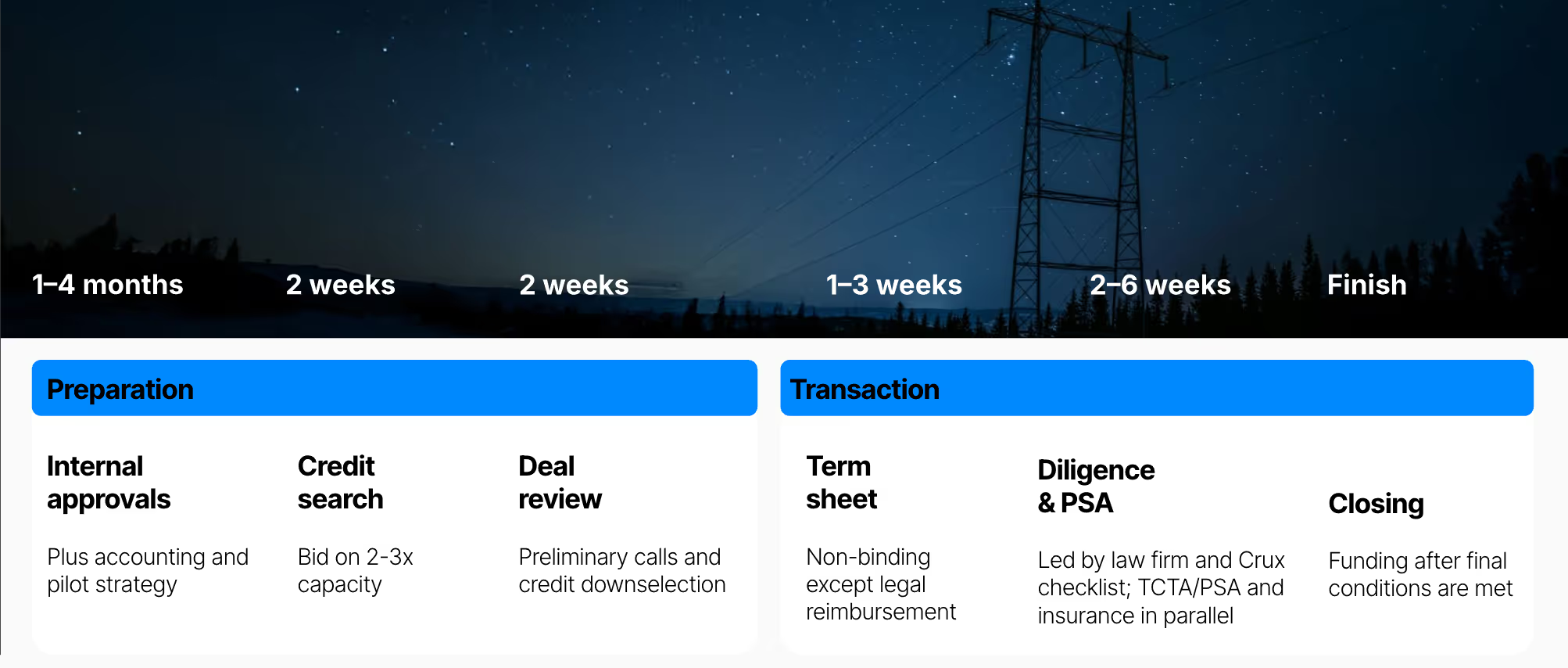

The relative simplicity of transferable tax credit transactions compared to other types of investment structures also means that due diligence is more straightforward and that deals typically take less time to close (usually within three months).

While tax credit transfers are simple relative to tax equity partnerships, they are still complex transactions. Tax credit buyers should understand the process and best practices to follow.

Typical tax credit purchase process and timeline

To purchase tax credits, a corporate entity must meet certain eligibility requirements:

*Note: Individuals and S-corporations should consult the rules on passive activity.

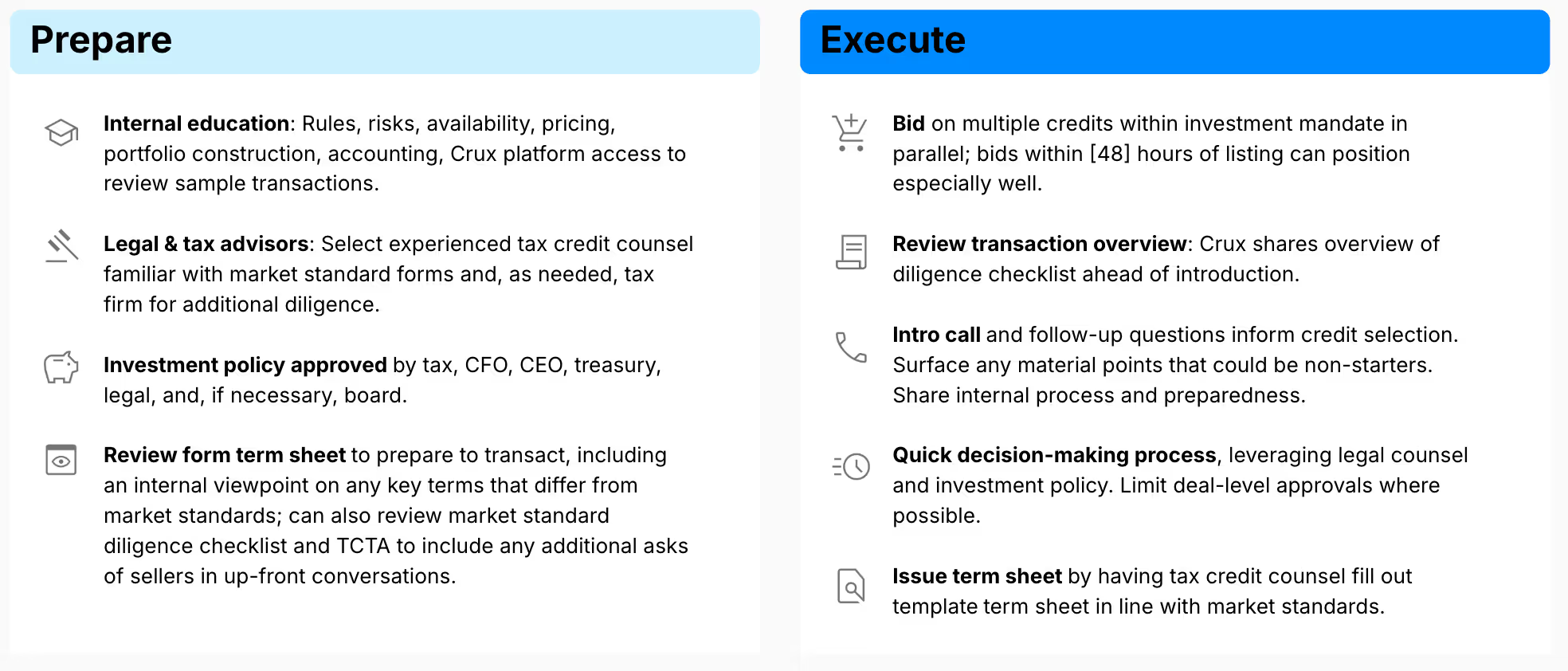

Internal education is a significant aspect of preparing for a tax credit transaction. Buyers should align with internal stakeholders (e.g., tax team, CFO, CEO, treasury, legal counsel) on an investment policy, including criteria around credit type (e.g., ITC or PTC, technology type), pricing, credit support, and timing of payment. Getting platform access to Crux to review listed credits can help all stakeholders understand the process early on.

Buyers should also start thinking about and involving relevant external parties, such as legal counsel, early. Outside tax advisors can help in understanding accounting implications and coordinate with legal experts. Select experienced tax credit counsel familiar with market standard forms and, as needed, a tax firm for additional diligence. Crux can always refer buyers to law firms and insurance brokers in its network.

After aligning on a tax credit strategy, buyers can search for credits matching their criteria on Crux’s marketplace. Saved searches will immediately notify buyers of new credits matching their criteria so they can be the first to bid. Many buyers will bid on multiple tax credits simultaneously, up to two or three times their capacity. Prior to entering exclusivity with a seller, there is no downside to bidding on multiple credits.

Best practices before and during a tax credit purchase

After signing a term sheet with a developer or manufacturer, buyers will work with their legal counsel and potentially a tax firm to diligence the credits. Working with experienced partners to conduct robust due diligence is important because it provides buyers with additional confidence that the credit has been appropriately de-risked.

The due diligence process will validate a range of important points, including:

In partnership with 35+ leading law firms and insurance brokers, Crux has developed the market-standard set of diligence checklists specific to each tax credit and technology type. These checklists are available directly in our platform to increase transparency and streamline transactions.

As the popularity of transferable tax credits grows, the market is becoming more competitive. According to Crux’s 1Q2025 Market Update, demand for tax credits consistently outranks supply. For 2024 tax credits, we estimated $4 of demand for every $1 of investment tax credits and $9 of demand for every $1 of production tax credits.

Seasonal pricing trends are emerging as the market matures. Buyers who move earlier in the year stand to benefit from wider credit availability and less competition. Entering the market earlier allows a buyer to ensure they get the credits — both size and type — that they want to satisfy their tax liability and increases their odds of getting a pricing discount.

Crux’s tax credit marketplace provides access to top-tier developers and manufacturers, making it easy for buyers to find tax credits that match their criteria. Contact us today to get started on the platform.